[ad_1]

Bitcoin (BTC) lost the momentum seen the day before and fell below $59,000 after bulls failed to push prices beyond the key $61,000 price point, which previously served as a support and resistance level.

The flagship crypto fell to a low of $58,866, wiping out almost all of the 3.2% gain recorded over the past day in an hour. At press time, BTC was trading at $59,200 – around the level where it began the brief rally earlier this week.

The most affected AI tokens

Meanwhile, the broader crypto market echoed the moves, with most suffering heavier losses than Bitcoin, which is still up 0.6% over the past 24 hours.

AI-focused cryptocurrencies led the market decline following a significant drop in Nvidia (NVDA) stock, which fell 6.4% after the company reported its quarterly results. Tokens like Render (RNDR), Artificial Superintelligence Alliance (FET), and Bittensor (TAO) all suffered losses ranging from 7% to 10%.

Large caps echoed Bitcoin’s moves, with Solana (SOL) and XRP posting the biggest losses of the day among the top 10. Ethereum (ETH) fell to $2,503 before bulls attempted to recover, while SOL fell to a low of $138.5.

Similarly, BNB fell to $530, while Toncoin (TON) remains under pressure due to recent issues related to network disruptions and the arrest of Telegram founder and CEO Pavel Durov.

Uncertain markets

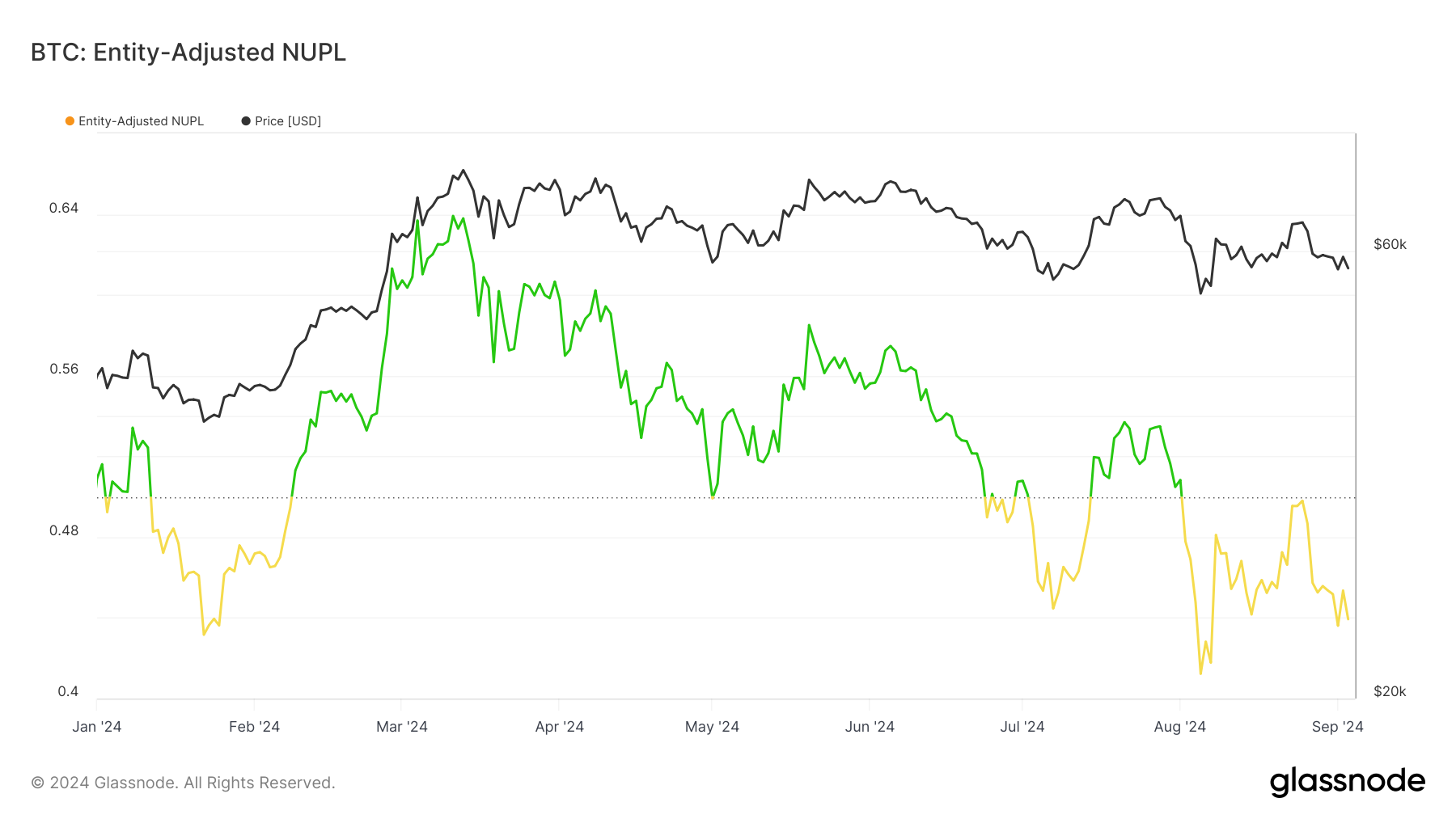

The pullback indicates continued difficulty for Bitcoin bulls to break above key resistance levels, raising concerns about the strength of the broader market. The market trajectory has been making lower highs and lower lows since March, highlighting continued uncertainty and volatility.

Price action suggests that the crypto market could be headed for further consolidation. Bitcoin’s rapid recovery after its fall below $50,000 in early August appears to be running out of steam, with the flagship crypto remaining in a downtrend since its all-time high of $73,000 in March.

The broader U.S. stock market mirrored the crypto market’s moves, with the tech-heavy Nasdaq reversing earlier gains to trade down 0.3% shortly before the close. The index had risen more than 1.5% earlier in the day, reflecting similar investor uncertainty.

Mentioned in this article

[ad_2]

Source link