[ad_1]

The funding rate is a key mechanism in Bitcoin perpetual futures contracts designed to keep the contract price as close as possible to the spot price of BTC. It is a periodic payment exchange between long and short traders, determined by the difference between the perpetual futures and spot prices. When the funding rate is positive, longs pay shorts; when it is negative, shorts pay longs.

Tracking the funding rate is essential for analyzing the market as it is one of the best indicators of trader positioning, especially in leveraged trading environments. A consistently high or positive funding rate indicates bullish sentiment as more traders are willing to pay a premium to hold long positions in a perpetual contract. Conversely, a negative funding rate indicates bearish sentiment as traders are more likely to short the asset and, in return, pay a premium.

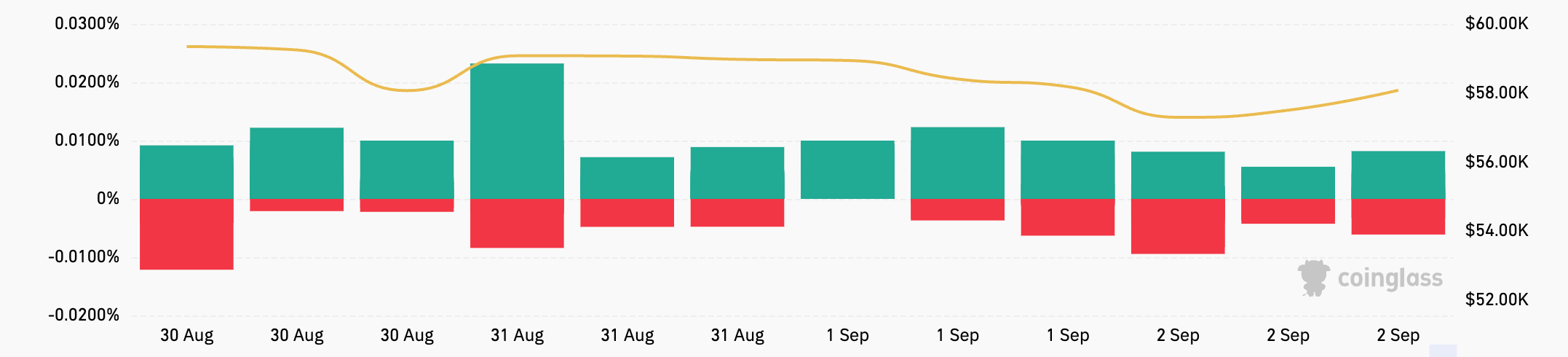

Throughout the weekend, funding rates for USDT and USD-margined contracts fluctuated across exchanges. On August 31, rates were mostly positive, showing bullish sentiment, albeit of varying magnitude. Bitmex had the highest funding rate at 0.0089%, while OKX had the lowest at 0.0029%. On September 1, there was a notable shift, particularly on Binance and Bybit, where rates turned negative at -0.0004% and -0.0009%, respectively. This showed an increase in bearish sentiment on these exchanges.

This trend continued on September 2nd and became more pronounced on Bybit and OKX, with both platforms posting negative funding rates of -0.0040%, indicating increasing short pressure. In contrast, Bitmex, which had the highest funding rate on August 31st, saw a significant drop to 0.0048% on September 2nd, although it remained positive. HTX’s funding rate also declined but remained positive at 0.0014%. Funding rates vary greatly across exchanges due to differences in sentiment and trader positioning on each platform, which are most likely influenced by liquidity, trading volume, and the specific trader base.

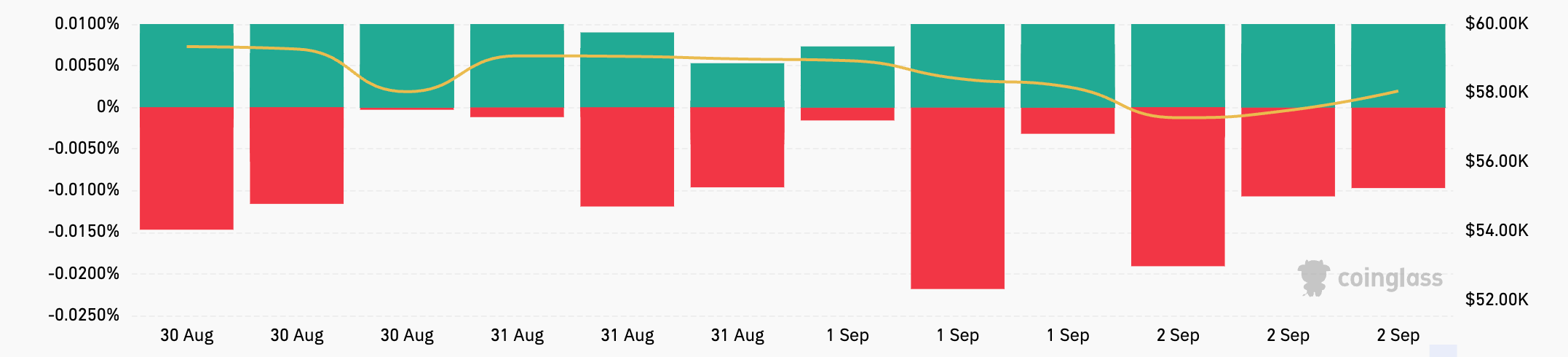

The funding rates for token-margined contracts during the same period were very different. On September 1, most exchanges recorded negative funding rates, with Bybit and OKX dropping to -0.0096% and -0.0044%, respectively. On September 2, the divergence became more pronounced, with Bybit’s rate dropping to -0.0191%, suggesting intense bearish pressure, while HTX saw a significant jump to 0.0100%, indicating a sharp reversal in sentiment on that exchange.

This disparity in funding rates between USDT/USD margined contracts and token margined contracts shows how differently traders in these markets behave.

USDT and USD margined contracts, settled in stablecoins and fiat currency, are generally preferred by traders who want to avoid exposure to Bitcoin price volatility when settling profits and losses. These contracts are popular among retail traders and those who use leverage to take directional bets on Bitcoin price movements without affecting their underlying Bitcoin holdings.

In contrast, token-margined contracts are settled in BTC or other cryptocurrencies, making them more attractive to traders with a long-term bullish view on Bitcoin or who are comfortable with the inherent risk of additional volatility. These contracts are often used by more sophisticated traders or those with a long-term holding strategy, as they offer the potential for greater gains and greater risk due to their exposure to the price of Bitcoin.

The differences in funding rates between these two types of contracts during this period indicate that traders have different risk appetites and strategies. The negative funding rates for token-margined contracts indicate that traders in these markets were more pessimistic or risk-averse, perhaps anticipating further declines in the Bitcoin price.

In contrast, the generally more stable and positive funding rates for USDT/USD margined contracts suggest that traders in these markets were either more optimistic or less concerned about short-term price volatility.

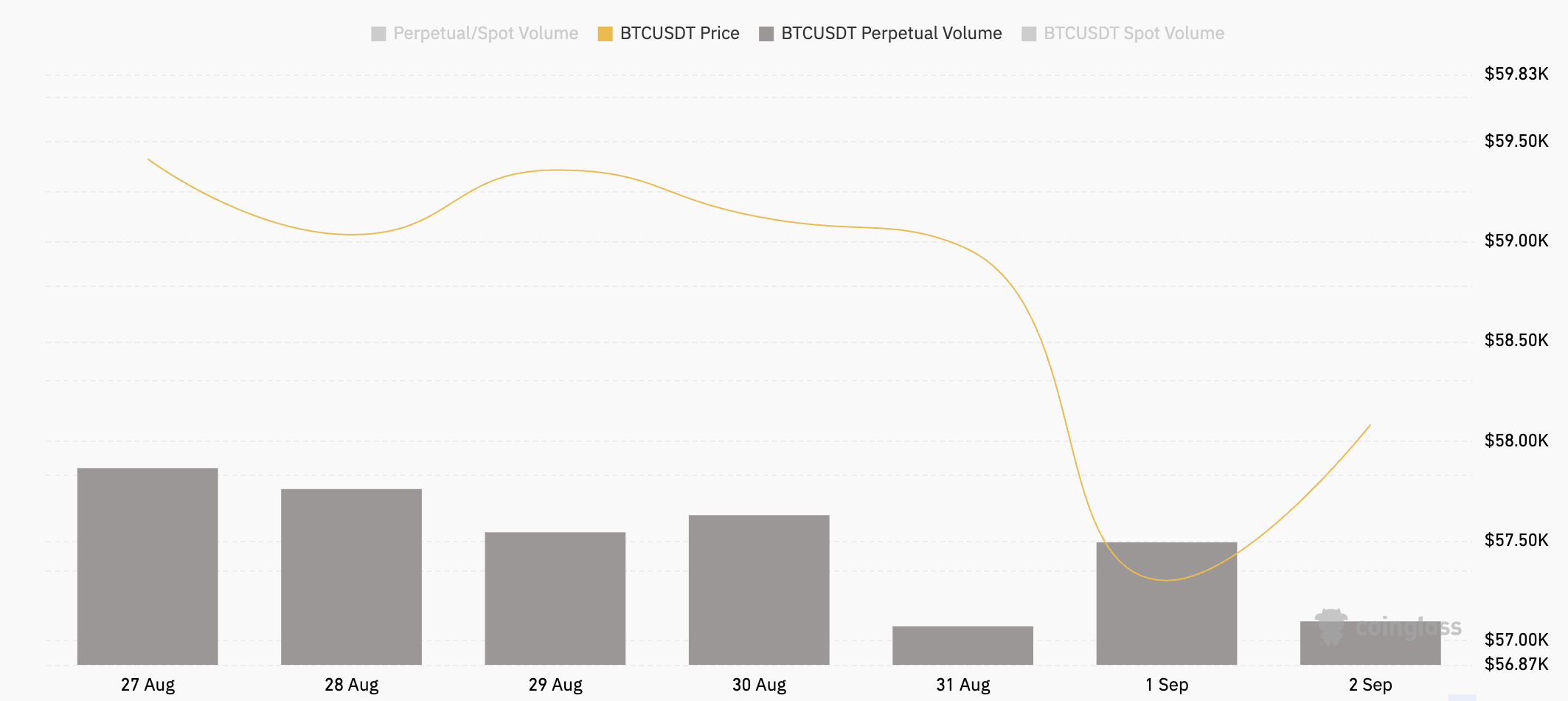

It is also important to analyze these changes in funding rates alongside the fluctuations in Bitcoin’s price. Over the weekend, Bitcoin’s price declined from $58,970 to $57,570, a relatively modest decline in the context of Bitcoin’s historical volatility. However, the sharp swings in funding rates, particularly the negative swings on Binance and Bybit for USDT/USD margined contracts and the extreme negativity for tokenized margined contracts, suggest that traders are increasingly positioning themselves for additional downside risk.

The overall decline in the volume-weighted funding rate from 0.0050% on August 31 to -0.0017% on September 2 shows how abrupt this shift in sentiment has been, as traders have increasingly taken short positions or reduced their exposure to long positions.

Perpetual futures trading volume also fluctuated significantly throughout the weekend, with sharp declines on August 31 and September 2, contrasting with higher volumes on September 1. This suggests that traders were taking profits or cutting losses amid market uncertainty, leading to lower OI and trading activity as funding rates began to move.

Bitcoin Funding Rate Volatility Shows Market Caution appeared first on CryptoSlate.

[ad_2]

Source link