[ad_1]

Onchain Highlights

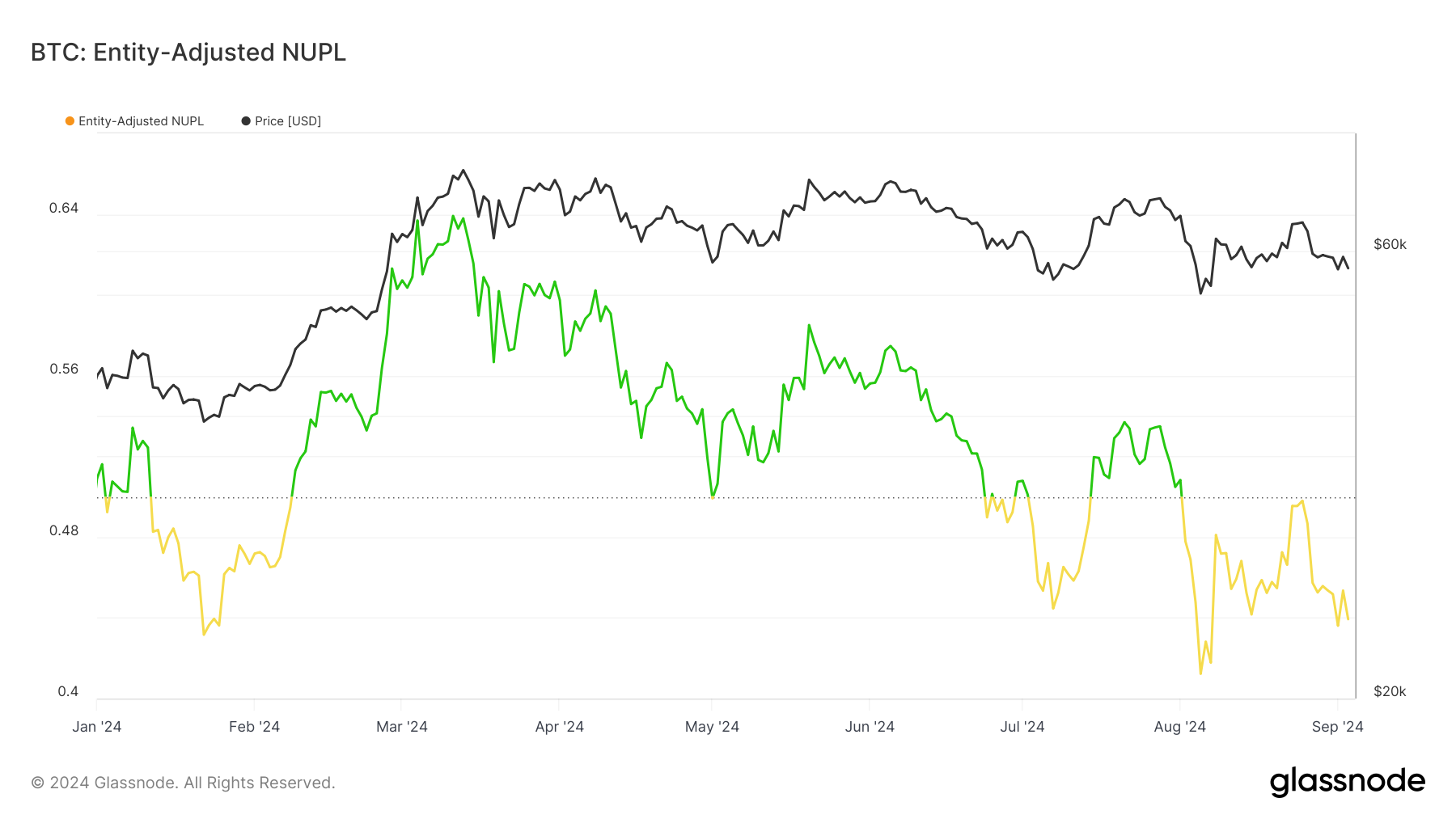

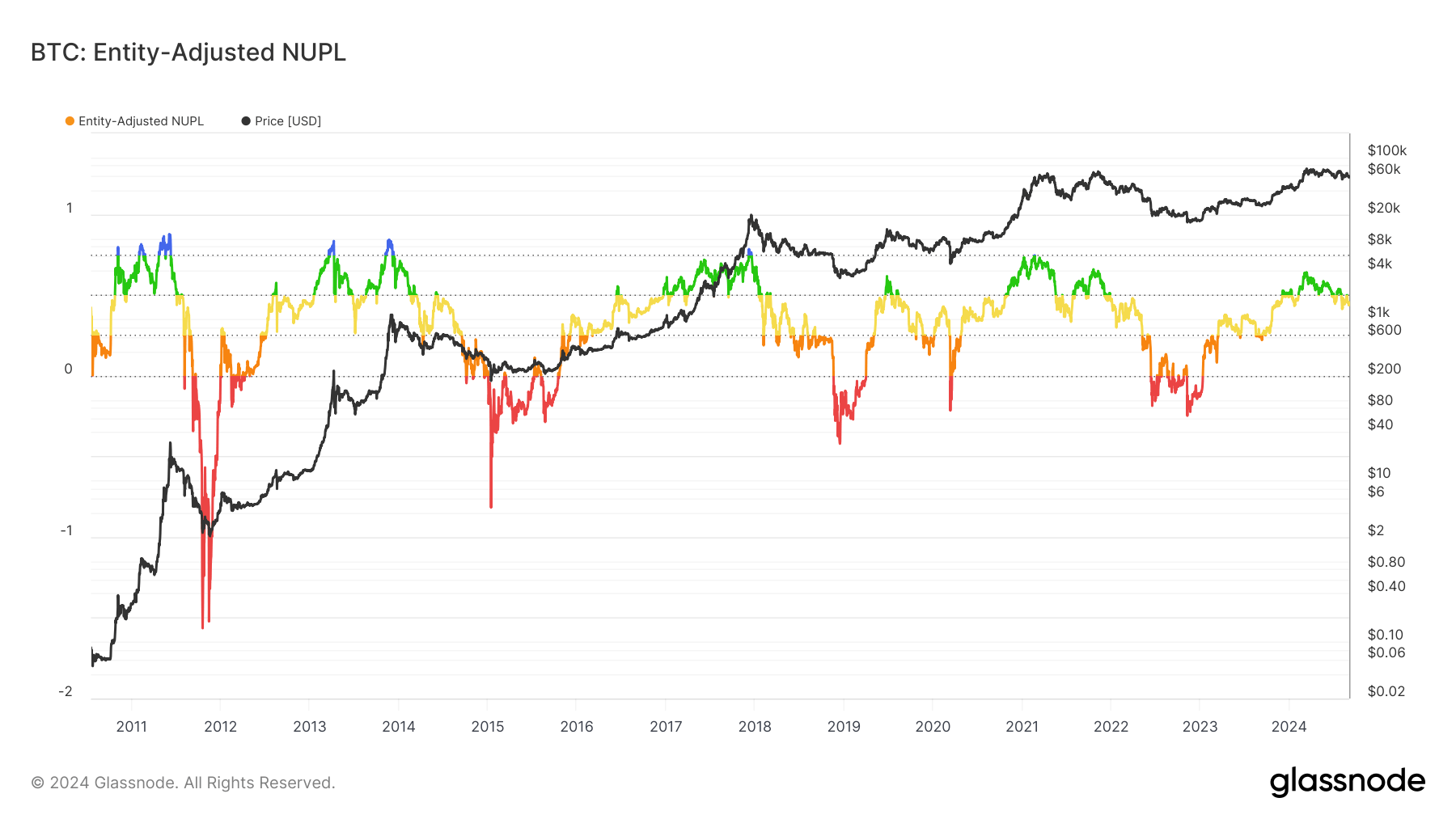

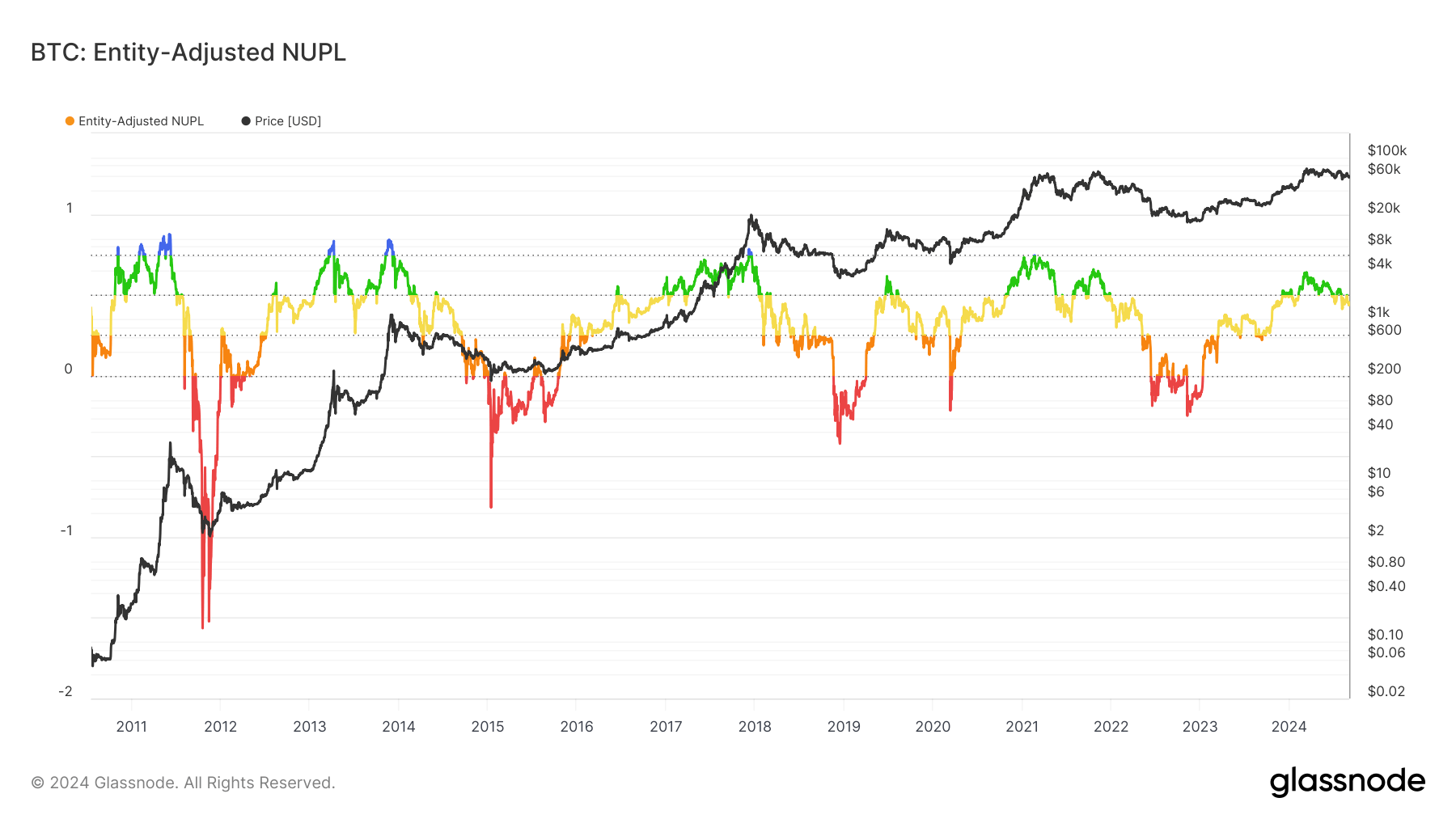

DEFINITION: Entity-adjusted NUPL is an enhanced variant of Net Unrealized Profit/Loss (NUPL) that eliminates transactions between addresses of the same entity (“internal” transactions). It only considers real economic activity and provides an improved market signal compared to its raw UTXO-based counterpart.

Bitcoin’s entity-adjusted NUPL has been in a downward trend since mid-2024, reflecting increased market uncertainty. This measure, which excludes internal transactions and focuses on external economic activity, has moved from positive territory at the start of the year to neutral and now close to loss levels.

Historically, similar changes in NUPL values have signaled market corrections or extended consolidation phases. This pattern aligns with Bitcoin’s recent price movements, which continue to hover below $60,000.

Comparing this to previous periods, a similar decline in NUPL was observed after the 2017 and 2021 bull cycles, preceding the Bitcoin market retracements. While NUPL is currently trending lower, previous cycles have demonstrated that a transition to the yellow and red zones often precedes a recovery phase. The current state highlights a potential shift in market sentiment, reflecting caution and reduced profitability for market participants.

[ad_2]

Source link